Paraqeet tracks generational shift in how we spend our money

Get it today even if you can’t afford it. That’s the idea behind BNPL companies – the buy now, pay later firms that are the latest rage in financial tech circles. Updating the age-old practice of layaway, companies such as Klarna, Affirm and Afterpay offer various interest-free installment payments, delayed payments and a wide range of interest rates on loans to consumers so they can buy what they want immediately. Retailers pay a fee for the service, which opens the door to instant buying gratification online and in person.

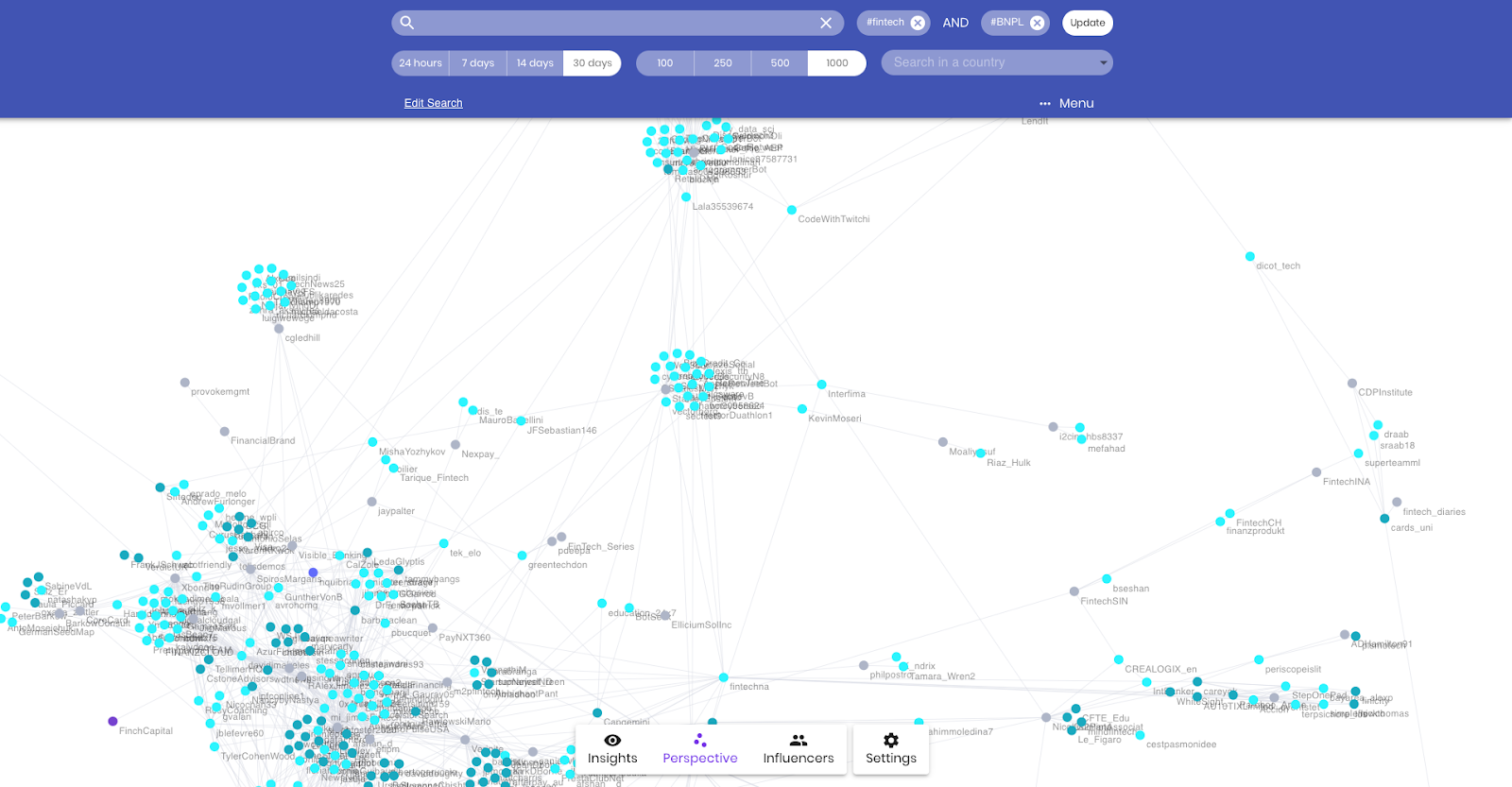

A Paraqeet search of those three companies and conversations around BNPL shows financial advisers, economists and market watchers dominate the conversation. They muse about the generational shift in how we spend money, wonder if the convenience is just a new way to rack up debt and speculate with excitement over the industry’s rapid growth.

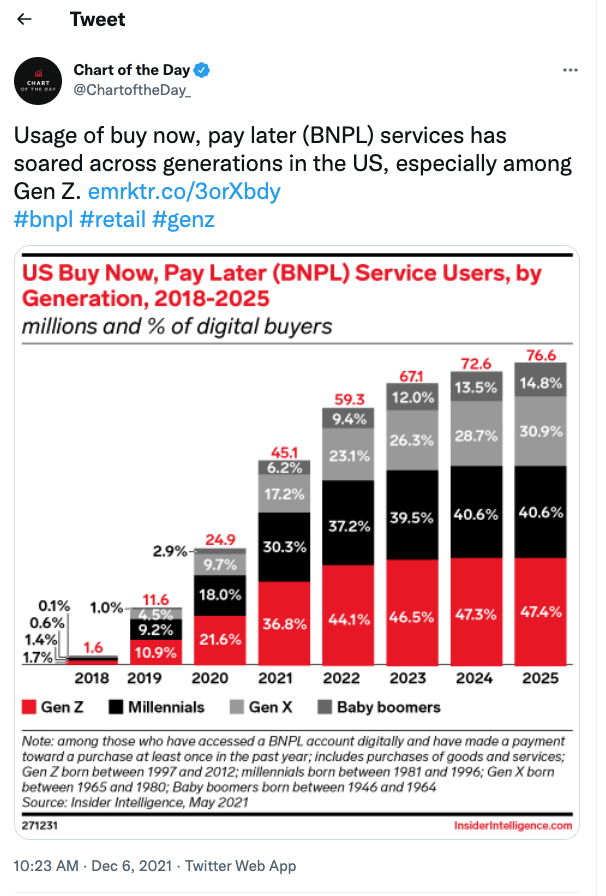

Thanks to the popularity of online shopping, the expectation of having merchandise available nearly as soon as it’s purchased and the pandemic fear of needing to hold on to cash, the companies’ usage rates have soared across all age groups but especially among the millennial and Gen Z crowds.

Multiple financial advisers and investing gurus retweeted a Forbes article on a new study that highlighted the importance of fintech in consumers’ lives. Gen Z was interested in cryptocurrencies, while among millennials the fastest-growing brands were five fintech newcomers. And even Gen X, generally in their 40s and early 50s, listed fintech brands Venmo and Chime, showing the new wave isn’t just for the young.

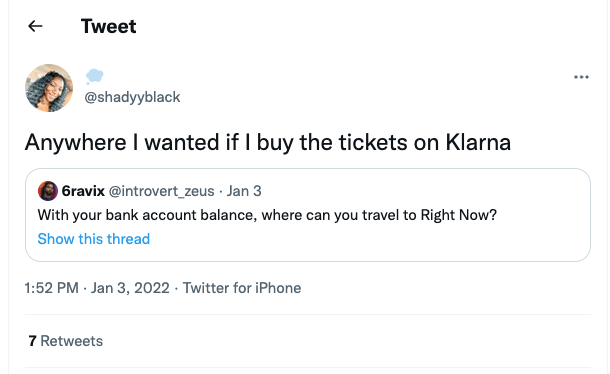

Sprinkled among the investor news and consumer spending trends was typical Twitter humor over how easy BNPL makes it to buy anything. User @Brands4_SA wondered: Can the #buynow #paylater model work on grocery #shopping? Another post featured a picture of an expensive watch with the question, How much to finance this over 60 years?? @Affirm

User @BMoeKnows said he invested in Affirm and wanted to see how it worked, so he used it to buy a patio heater on Amazon. “It was the absolute easiest loan process I’ve ever been a part of in my life,” he wrote. “They’ve changed the game!!”

In response, @Dealfin14503074 said customers in his retail business have used it to buy furniture and flooring. “It has given them a virtual card that they’ve used and we’ve made some pretty big sales just mentioning it to customers in the store. Very good.”

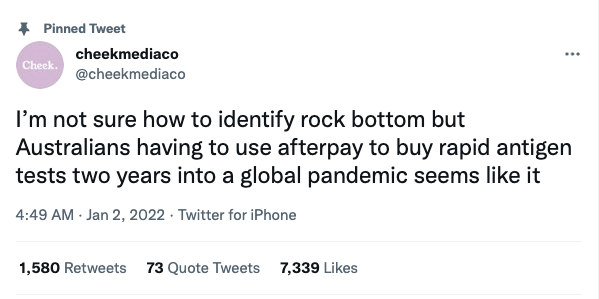

Of course, every good news story has a dark counterpart. Paraqeet easily found laundry lists of complaints, particularly about Affirm’s lackluster customer service and seeming inability to issue refunds. Another thread spawned debate about the failings of the public health system as people used BNPL services to buy COVID-19 tests.

Considering that the explosive growth has come with little regulation, the Consumer Financial Protection Bureau has stepped in to review various issues surrounding the BNPL industry, from debt accumulation to data harvesting, in the name of protecting consumers.

All roads point to Gen Z shoppers continuing to fuel the industry’s growth and the government eventually developing regulatory controls on it. Paraqeet provides a quick, convenient way to keep tabs on how our spending practices are changing, customer insights into the evolving industry and any future regulatory roadblocks.

Meanwhile, shoppers grabbing their goods with BNPL may want to keep this thought in mind: